Did you know that over 80% of cryptocurrency trades are executed by automated trading bots? In a market where prices can swing wildly, traders need precision, speed, and strategy. Enter Grid Trading Bots, popular among both novice and seasoned traders. These bots thrive in volatility, placing buy and sell orders at set intervals to capture profits.

Impressively, a recent study found that traders using Grid Trading Bots can increase profitability by up to 40% compared to manual trading. This highlights the importance of Grid Trading Bots as essential tools for navigating the unpredictable crypto market.

Definition of Grid Trading

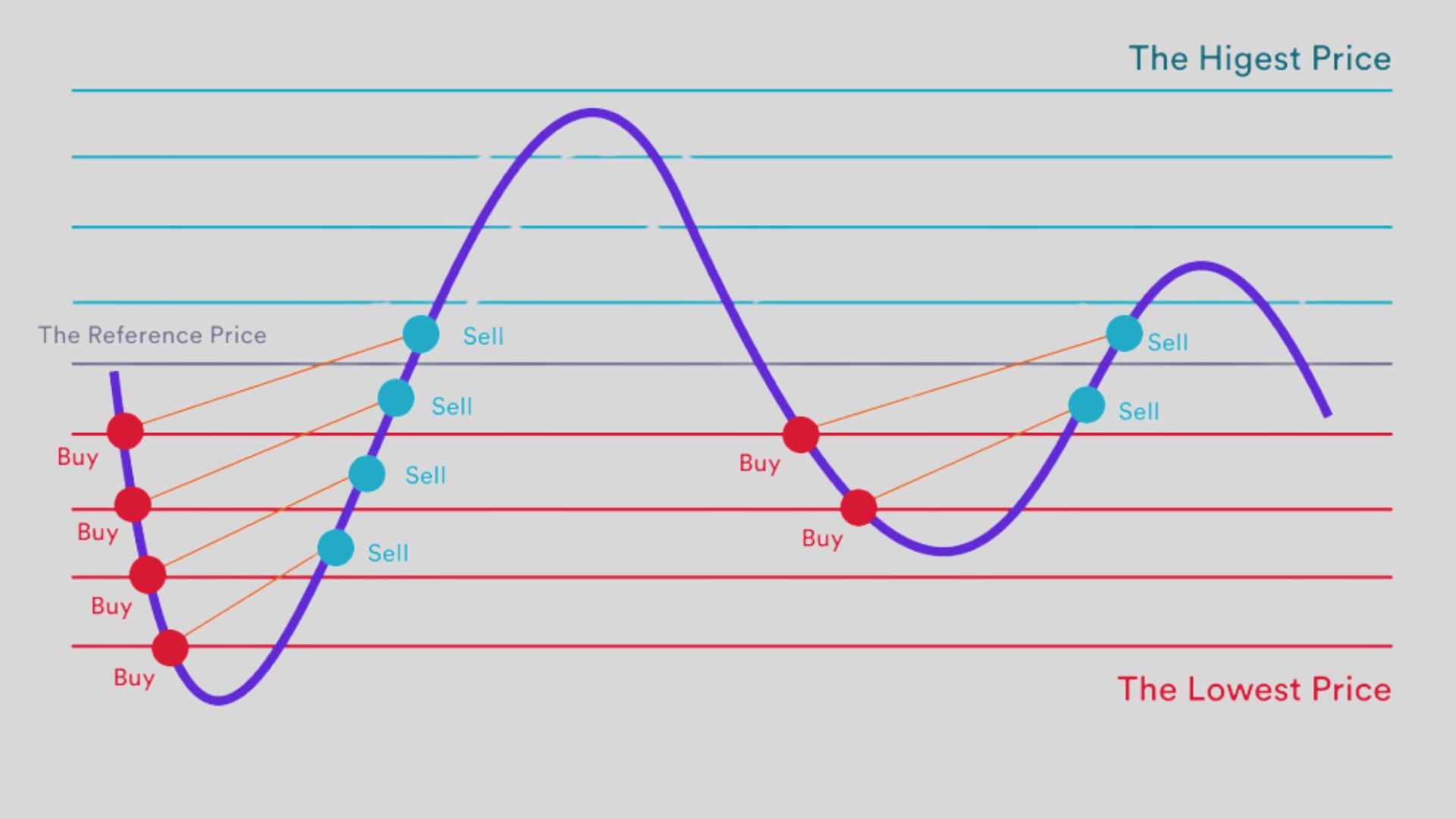

Grid trading is a systematic strategy that involves placing multiple buy and sell orders at set price intervals above and below the current market price. Essentially, a “grid” of orders is created, allowing traders to capitalize on market fluctuations by buying low and selling high within a defined range.

This strategy is particularly effective in sideways or range-bound markets, where prices oscillate within a specific band. It is inherently neutral, thriving on volatility without needing a particular market trend to generate profits. The more the price fluctuates, the more opportunities arise for executing buy low, sell high cycles.

In the crypto market, grid trading is especially appealing due to the high volatility and frequent price swings of digital assets. Unlike traditional markets, cryptocurrencies can experience significant price changes in short time frames, making the Grid Trading Strategy a powerful tool for capitalizing on these movements.

Key Concepts

At its core, the Grid Trading Strategy involves creating a “grid” of buy and sell orders at predetermined price levels. This grid forms a network of trades that are executed automatically as the market price fluctuates. The primary components of a grid include:

Price Range: The upper and lower boundaries within which the grid operates.

Grid Spacing: The distance between each order in the grid, which determines how frequently trades are executed.

Order Quantity: The size of each buy or sell order within the grid.

The flexibility of the grid strategy lies in its adaptability to different market conditions. In a highly volatile market, a tighter grid with smaller spacing is often more effective, allowing the bot to capitalize on frequent price swings. Conversely, in a stable or slowly trending market, a wider grid can be used to capture larger price movements.

This adaptability makes grid trading suitable for various scenarios, from aggressive high-frequency trading to more conservative long-term strategies. By adjusting the grid parameters, traders can tailor the approach to align with their specific risk tolerance and market outlook.

How Grid Trading Bots Work?

Grid Trading Bots are automated tools that execute the Grid Trading Strategy with minimal manual intervention. They are designed to handle the repetitive and time-sensitive nature of grid trading, ensuring that orders are placed and executed at optimal times, regardless of market conditions or the time of day.

The grid trading algorithm divides a predefined price range into segments, placing buy and sell orders at each level. For example, if Bitcoin’s price is $30,000 and a trader sets a grid with intervals of $1,000, the bot would place buy orders at $29,000, $28,000, $27,000, and so on, while simultaneously placing sell orders at $31,000, $32,000, $33,000, etc.

As the market price fluctuates, the bot automatically buys when the price drops to one of the lower levels and sells when it rises to a higher level. This process repeats continuously, allowing the bot to profit from price movements within the grid’s range.

Benefits of Using a Grid Bot

One of the primary advantages of using a Grid Trading Bot is its ability to capitalize on market volatility. Unlike manual trading, where traders might miss opportunities due to time constraints or emotional decision-making, a grid bot operates continuously, executing trades as soon as market conditions align with the pre-set strategy.

This continuous execution is particularly crucial in the crypto market, where price changes can occur rapidly and unpredictably. By automating the process, traders can ensure that their strategy is implemented consistently, even when they are not actively monitoring the market.

Moreover, the use of a Grid Trading Bot helps reduce the impact of emotions on trading decisions. In volatile markets, traders can easily fall into the traps of fear or greed, which can lead to poor decision-making. A bot, however, follows the predefined strategy without deviation, helping to maintain discipline and adherence to the trading plan. This can ultimately lead to more consistent results and improved trading performance.

Advantages of Using a Grid Trading Bot in Crypto

Consistent Profit Generation

One of the most compelling reasons to use a Grid Trading Bot is its potential for consistent profit generation. By exploiting market fluctuations, grid bots can systematically capture small gains with each cycle of buying low and selling high. These incremental profits can accumulate significantly over time, especially in a highly volatile market like cryptocurrency.

For example, a trader might configure a grid bot to trade a cryptocurrency like Ethereum within a $100 price range, with orders spaced $10 apart. As the price fluctuates within this range, the bot continuously buys at lower prices and sells at higher prices, generating profits on each completed cycle.

Real-world examples of successful grid bot trading often highlight the strategy’s effectiveness in markets that exhibit frequent price swings. During periods of high volatility, a well-configured grid bot can generate consistent returns by capitalizing on the rapid price changes that occur within its defined grid. This ability to harness market movements efficiently makes grid trading a popular choice among both novice and experienced traders looking to enhance their trading strategies.

Risk Management

Another significant advantage of Grid Trading Bots is their effective risk management. By diversifying trades across a wide price range, the bot minimizes the impact of any single adverse price movement, ensuring that traders are not overly exposed to any one market condition.

Most grid bots also allow for setting stop-loss and take-profit levels, further enhancing risk control. A stop-loss order limits potential losses if the market moves beyond the grid’s range, while a take-profit order secures gains once a specified profit level is reached.

Best Grid Trading Strategy

To maximize returns, traders should identify the best grid trading strategies for their specific market conditions. A tighter grid with smaller intervals is ideal for highly volatile markets, enabling the bot to capture frequent price swings. Conversely, a wider grid suits less volatile markets, focusing on larger price movements.

The adaptability of grid bot strategies is crucial for success. By adjusting parameters like spacing, order size, and price range, traders can fine-tune their strategies to align with their market outlook and risk tolerance.

Choosing the Best Grid Trading Bot

Key Features to Look For

When choosing a Grid Trading Bot, several key features impact its effectiveness. Customization options enable traders to tailor the bot’s behavior to their specific needs by adjusting grid spacing, order size, and stop-loss levels.

Backtesting capabilities are crucial, allowing traders to test their grid strategies against historical data. This feature provides valuable insights into potential effectiveness before deploying the bot in a live market.

Ease of use is another important consideration, especially for less experienced traders. A user-friendly interface and clear documentation facilitate setup and management, ensuring smooth bot operation.

Comparison of Top Grid Bots

Several grid trading bots are available in the market, each with unique features and benefits. When comparing them, traders should consider usability, performance, security, and customer support.

For instance, some bots may provide advanced customization options and backtesting capabilities, while others prioritize ease of use and robust customer support. By evaluating these factors, traders can select the bot that best aligns with their trading goals and experience level.

User Experience and Support

User experience is a critical factor when selecting a Grid Trading Bot. A well-designed interface and intuitive controls simplify the setup and management of grid strategies, reducing the risk of errors or misconfigurations.

Reliable customer support is also essential, especially for traders new to automated trading. A bot provider that offers responsive support can promptly address any issues or questions, ensuring the bot operates smoothly and effectively.

Optimizing Your Grid Bot Strategy

Backtesting and Refinement

Before deploying a grid bot in a live market, it’s crucial to backtest the strategy using historical data. Backtesting enables traders to assess how the grid bot would have performed under various market conditions, providing valuable insights into its potential effectiveness.

After backtesting, the strategy can be refined based on the results. For instance, if the backtest indicates that the grid spacing was too wide, leading to missed trading opportunities, the trader may adjust the spacing to capture more frequent price movements. This iterative process helps optimize the strategy, enhancing its performance before live execution.

Adapting to Market Conditions

Market conditions can change rapidly, and a successful grid bot strategy needs to be adaptable. Traders should regularly monitor the bot’s performance and make real-time adjustments to the grid parameters as needed. For instance, if the market becomes more volatile, the trader might tighten the grid to capture more frequent price swings.

By staying vigilant and making timely adjustments, traders can ensure that their grid bot strategy remains effective, even as market conditions evolve.

Conclusion: Why Choose CoinsQueens for Your Grid Trading Bot Development

At CoinsQueens, we understand that successful crypto trading requires the right tools and strategies. Our expertise in grid trading bot development is designed to help you capitalize on market volatility with precision and efficiency. Whether you’re a seasoned trader looking to automate your strategy or a newcomer eager to explore the benefits of Crypto Trading Bot, our custom-developed bots offer the flexibility, reliability, and performance you need to stay ahead.

With CoinsQueens, you gain more than just a trading bot—you get a partner committed to your success. Our team of experienced developers and market analysts work closely with you to create a grid trading bot tailored to your specific needs, ensuring that it aligns perfectly with your trading goals. Plus, with our ongoing support and cutting-edge technology, you can trust that your bot will continue to perform optimally in any market condition.

Take your crypto trading to the next level with CoinsQueens. Let us help you develop a grid trading bot that turns market fluctuations into consistent profits. Contact us today to get started!

If You Are Interested,

Book A Free Business Demo!!